Rising Tides Sink All Boats (6/12/2024: Weekly ComBoy Crude and Gasoline Newsletter)

- thecommoditiesboy

- Jun 12, 2024

- 3 min read

TLDR whole article: Bearish...

More specifically energy boats lol. Would you look at that, another weekly build across the board (minus disty) but generally pretty bearish.

It's kind of funny, and I know I've said it a few times, but Joe Biden might honestly be the best crude trader out there. Dumped SPR at the right time, refilling at the right time. Demand weak. What more can we ask for...

But let's look at the numbers and see what they mean:

__________________________________________________________________

Crude:

TLDR: Bearish man like there is a sea of crude out there and we won't stop pumping more out of the ground

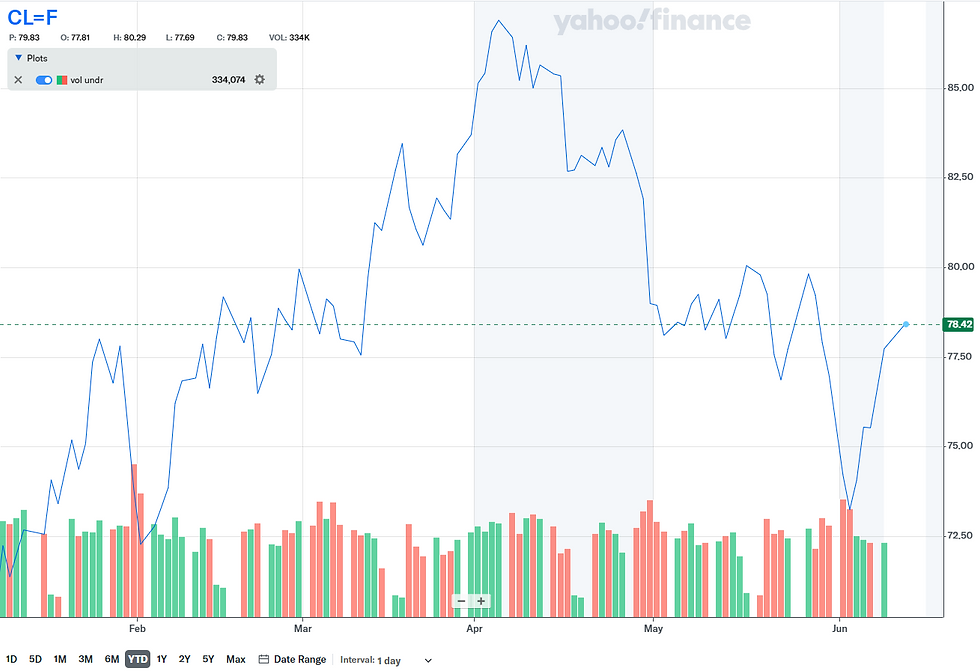

Crude, my sweet, dear, WTI crude what has been going on with you. Some of the lowest inventory out there, OPEC cuts, and yet you're still coming down from your April highs...

I guess everyone on #oott was too bullish on you about how strong demand would actually look like...

July contracts last traded $78.42 after a minor rebound this week but down from their highs at $85+/bbl

Why is that? Well, let's just look at three very very very simple things:

Production running full steam ahead with literally little to no sign of slowing down

SPR Inventory and Total Crude Inventory climbing back up

What am I trying to show with this data? Well, with the current rate we're producing at and the depleted levels of consumption, we're looking at a pretty drastic build cycle month after month

Every month we stay above the 0 line, we're looking at builds. The majority of the years typically feature draws during this season. The only notable exception to this rule is 2020...

And guess what, this gets reflected in the pricing to absolutely no one's surprise. When you go from the expectation of massive draws and massive demand builds to the cycle we're in right now, there's not much more justification left for earlier calls for $100/bbl+

If this keeps up past the summer peak season, I wouldn't be surprised to see us back into the low 60's again...

Ft. the backwardation on crude

__________________________________________________________________

RBOB/Gasoline:

TLDR: Bearish cuz who is driving anymore right now - I actually teleport to work everyday

Let's start with the demand picture:

We're looking at sluggish demand and we even saw a slight decline of a little over 1000kbd per week WoW...why is that the case even as gasoline gets cheaper?

Well my personal theory is that people can't afford to go out anymore and do things. You're never going to get rid of the gasoline demand but as EV's take over and as everyone gets priced out of summer vacations, trips to the Hamptons, their weekly date night your driving demand is going to get lower and lower.

And let's be honest, trading energy is never about trading supply (I mean yes it is, but supply to me is a derivative of demand) but more importantly about demand. If we're seeing such high levels of demand destruction where people aren't driving despite gas being 4% cheaper YoY according to AAA:

There is something seriously wrong with the consumer. Demand is not what it's supposed to be. Demand isn't going to be what it's supposed to be if the macro outlook is so sh*t

Anyway, look at supply since people care about that too:

Like hello? You have two supply years that are higher than where we are today - both heavy COVID years...we have enough gasoline for everyone and their mothers and a few other countries too probably

Days of supply is averaging at 25.6 days right now versus 23.82 from last year. Long story short, we have a deluge and no one is driving

No wonder prices are going to come off brother

More backwardation

__________________________________________________________________

Pls subscribe thanks

Comments