$NRP (Natural Resource Partners): Steady As She Goes

- thecommoditiesboy

- Jun 17, 2024

- 3 min read

(Disclaimer: Literally none of this is financial advice. If you take this as financial advice, the only thing you better be sending me are sad cat gifs. I am not liable for your financial gains or losses - this is just my uninformed opinion. Also everyone should be properly credited for their work - if I didn't let me know and I'll fix it)

Current Performance Snapshot (As of Close 6/14/2024):

__________________________________________________________________

Price as of June 14, 2024: $89.5

Market Cap: $1.16B

P/E Ratio: 6.61

Dividend Yield: 3.35%

__________________________________________________________________Daily Chart Snapshot (As of Close 6/14/2024):

Very rarely does something exist where you meet three sets of pre-conditions:

Sustained high margins on a core product or service

Sustained forecasted high margins based on the product/service supply and demand

Efficient management that steers the ship steadily

NRP manages to be all of that and then some more. As we've mentioned in the past, met coal and coal in general has a great macro outlook. You can read more by clicking here

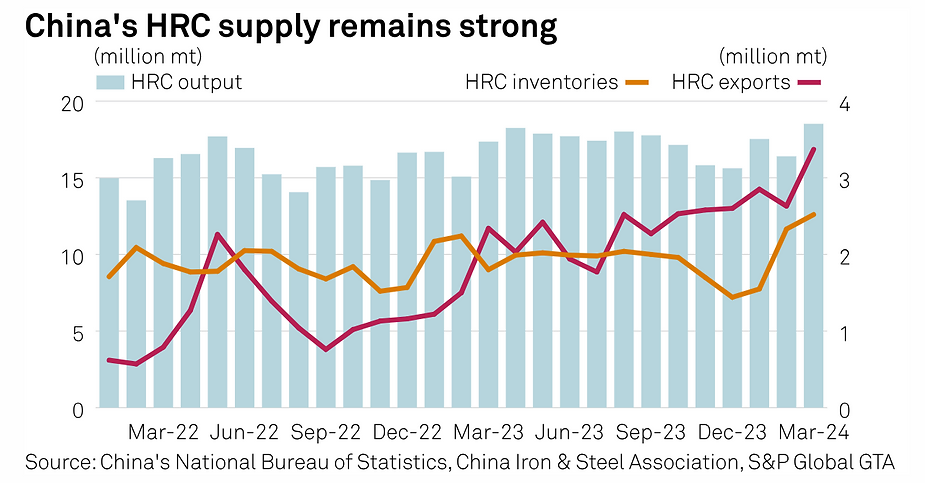

The TLDR of all of this is that a) China and India are producing a lot of steel and to produce a lot of steel you need a lot of met coal and b) the US is producing and exporting record quantities of the said products

__________________________________________________________________

$NRP Fundamentals:

First off, what is NRP?

Natural Resource Partners (I swear this is not chatgpt generated) is not your traditional energy company - it's a portfolio style MLP company that owns, manages, and leases a diversified portfolio of mineral properties with a focus on Mineral Rights and Soda Ash.

As usual, we're keen on the Mineral Rights with access to high margin coal profits. The mineral rights make up around 13 million acres of mineral interests that provide inputs for steel manufacturing (met coal), electricity (thermal), and other industires.

Soda Ash is made up of around 49% non-controlling equity in Sisecam Wyoming, which is ore mining and soda ash which is used for domestic and internal use for glass and chemical industries.

Let's break down the earnings:

Holistic View:

Cash generated was $72.1 FCF for Q1 Y24 with repurchase of 1.2M warrants and 198,767 common units. Credit facility was increased and $0.75c per unit common unit distribution issued and $2.44 per common unit distributed for assistance with tax liability due to special MLP structure. Main key is that zero warrants remain outstanding.

The Partnership is officially warrant free and management makes considerable progress toward bringing down debt. While FCF reached record levels, with met coal prices and soda ash prices outlook looking flat (to slightly bearish according to the earnings report) they are making a drive toward solidifying and eliminating debt.

Here is a good snapshot from AlphaSpread:

Mineral Rights:

Mineral rights net income, operating cash flow, and FCF decreased by $8.2M, $4.1M, and $4.1M respectively driven by lowered by decreasing met coal prices. However, as long as the prices remain above historical prices and the ability to increase production capacity is constrained, we should see elevated coal prices which should provide a floor to the FCF.

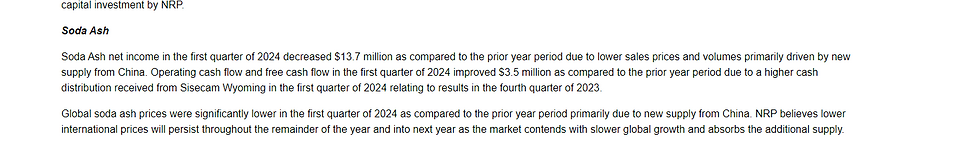

Soda Ash:

To be honest, I don't know jack about Soda Ash but it does look like similar to coal, there was noticeable weakness and does remain a risk.

Instead of me trying to explain it, here's a screengrab from their website:

Management:

I want to make a special note on the management which is the real driver behind why I want to buy this company. Not only are they bending over backward to completing their fiduciary duty of rewarding the share/unit holder they are making noticeable and meaningful progress toward eliminating. At this rate, we should be looking at no debt around this time next year.

Outlook:

$NRP is on the verge of eliminating all their debt. It's also on the verge of giving back 20% of it's FCF back to its shareholders (as it's meant to be - Benjamin Graham would be proud).

If prices for met coal and thermal coal remain at levels we're currently seeing them at least a $100+ per share along with a 15% yield post tax....

That's not a bad deal for a buy and hold play. Time to start sizing in...

__________________________________________________________________TLDR: Great store of value until the price starts moving up

Comments